Mitchell Insurance Agency Provides Personal, Commercial, Home & Life Insurance.

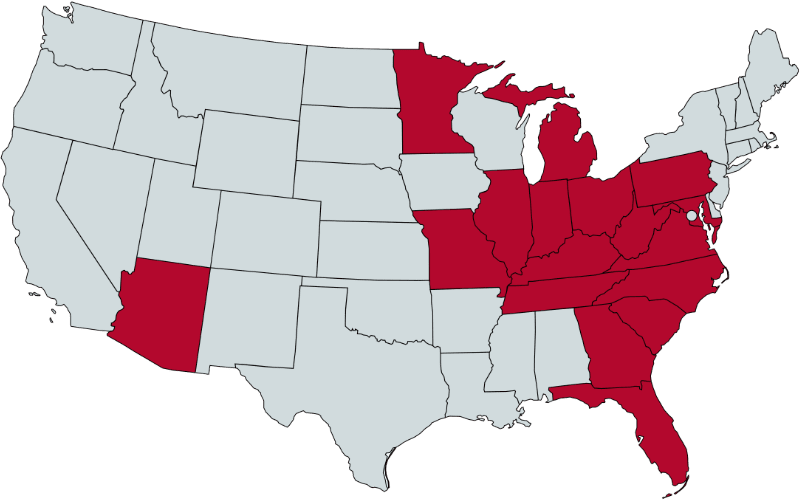

Insuring All of Ohio, Kentucky, Florida, and 14 Other States.

WHAT TYPE OF INSURANCE?

It’s easy to run down a checklist of the type of insurance we need to protect ourselves. Home insurance, car insurance, life insurance, business insurance, etc. However – when life takes an unexpected turn, will you have the right insurance, the right coverage to protect yourself and your family?

This is where Mitchell Insurance excels as specialists in insurance coverage and products. Your Mitchell Insurance Agent can use this knowledge to guide you through options right for you and your individual situation.